In 2019, Germany established its new climate protection law, and within this law, fixed targets were set for the reduction of greenhouse gas emissions between 2020 and 2030. One of the main targets outlined in this agreement is that by 2030, Germany must produce 55% less greenhouse gas emissions than they did in 1990.

What is the CO2 tax?

The upcoming CO2 tax, which comes into effect from 2021, primarily focuses on companies trading in fuel oil, natural gas, petrol and diesel, with a fee being paid on the calculated CO2 emissions. Greenhouse gas emission certificates will have to be purchased for their products, and the number of these certificates in circulation will be reduced every 12 months. These targets are based on those set by the EU for non-ETS (Emissions Trading Scheme) sectors.

What will be the price per ton?

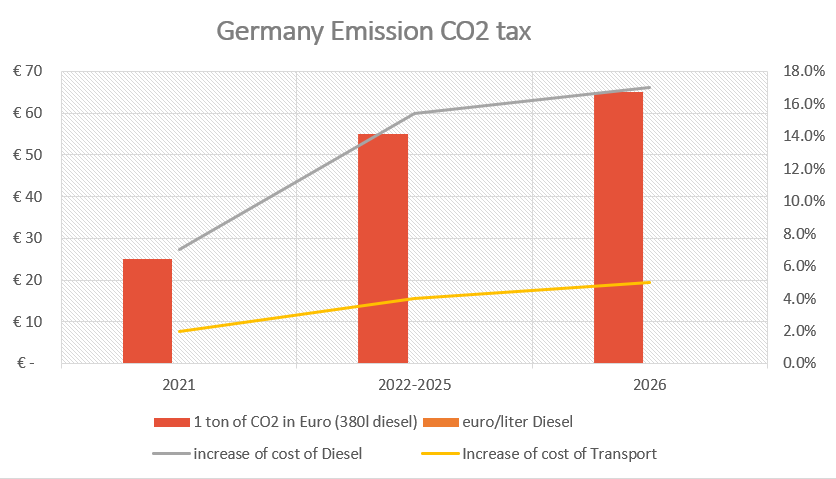

During the start-up phase in 2021, the price will be €25/tCO2, afterwards the price per ton of CO2 emitted will increase every year until 2026:

- 2022: €30/tCO2

- 2023: €35/tCO2

- 2024: €45/tCO2

- 2025: €55/tCO2

From 2026 the certificates will be sold via auction and the price corridor will be between €55/tCO2 – €65/tCO2.

What will be the impact of the costs?

The CO2 tax relates to all emitted fossil fuels, and therefore will have a direct impact on the cost of fuel. Based on 2020 fuel costs, the CO2 tax will lead to a price increase of ~7% (0.07€/l Diesel) in 2021. By 2026, the price will have increased by 17% (0.17€/l Diesel) when compared to 2020.

The fuel for a commercial fleet is responsible for approximately 25% to 33% of the total transport cost. As a result of the CO2 tax, these costs will increase by 2% in 2021, with this increasing to 5% by 2026 (when compared to costs in 2020).

How is it handled in other European countries?

The CO2 tax is not a new creation by the German government, and several countries in Europe have been charging a tax for each tonne of CO2 emitted since the early 1990s. As it currently stands, there are 12 countries in Europe that have a similar policy in place, but because the taxes aren’t regulated by the EU, the prices range from 0,07€/tCO² in Poland and up to 115€/tCO² in Sweden.

What is the impact to commercial fleets?

The main effect of the upcoming CO2 tax will be its impact on the total operation cost of the fleet. In the first year, fuels costs will increase by over €2,000 per truck/trailer. By 2026, this will increase to €5,000 per truck/trailer. These calculations are based on a yearly mileage of 100,000 km, with an average consumption of 32 litres. For a fleet consisting of 100 vehicles, this will increase yearly costs by over €500,000 in 2026. N.B. These calculations are based on the price of fuel in November 2020, and do not account for inflation.

If you have any queries about the upcoming tax in Germany, and would like to discuss how we may be able to support your business in counteracting some of these additional costs, please get in touch with the team at CDRS.

Sources:

Umweltbundesamt: https://www.umweltbundesamt.de/daten/klima/treibhausgasminderungsziele-deutschlands

Presse- und Informationsamt der Bundesregierung: https://www.bundesregierung.de/breg-de/themen/klimaschutz/nationaler-emissionshandel-1684508

Bundesministerium für Umwelt, Naturschutz und nukleare Sicherheit (BMU): https://www.bmu.de/faqs/nationaler-zertifikatehandel-fuer-brennstoffemissionen/

Süddeutsche Zeitung: https://www.sueddeutsche.de/wirtschaft/co2-steuer-deutschland-2021-1.4913406

Bayerischer Rundfunk: https://www.br.de/nachrichten/deutschland-welt/co2-steuer-in-mehreren-eu-laendern-laengst-standard,RVyr5aE

Deutsch-französisches Büro für die Energiewende: https://energie-fr-de.eu/de/effizienz-waerme/nachrichten/leser/memo-zur-co2-bepreisung-in-frankreich.html?file=files/ofaenr/04-notes-de-synthese/02-acces-libre/05-efficacite-et-flexibilite/170626_Memo_CO2-Bepreisung_in_Frankreich_DFBEW.pdf